6 Easy Facts About Paul B Insurance Medicare Advantage Plans Explained

Table of ContentsPaul B Insurance Medicare Advantage Plans Can Be Fun For AnyonePaul B Insurance Medicare Advantage Plans Can Be Fun For AnyoneThe 9-Minute Rule for Paul B Insurance Medicare Advantage PlansThe Of Paul B Insurance Medicare Supplement AgentPaul B Insurance Best Medicare Agent Near Me Fundamentals ExplainedExcitement About Paul B Insurance Best Medicare Agent Near MeSome Known Questions About Paul B Insurance Medicare Agent Near Me.The 9-Second Trick For Paul B Insurance Best Medicare Agent Near Me

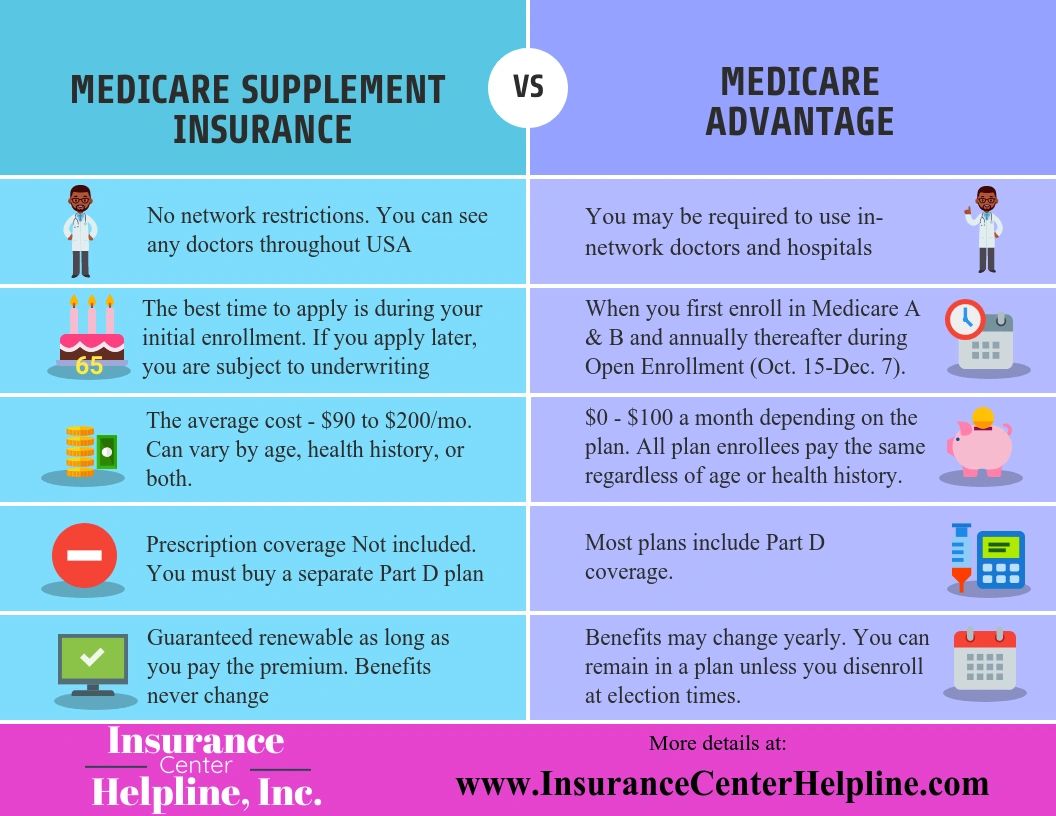

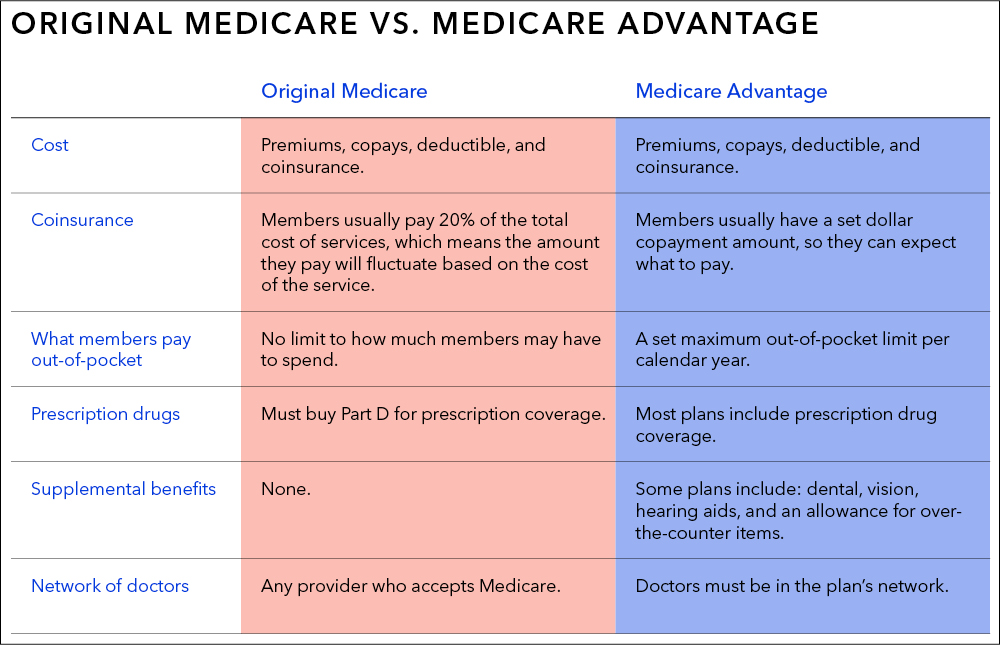

Evaluation the most commonly asked questions about Medicare Advantage prepares listed below to see if it is ideal for you. BROADEN ALL Medicare Benefit prepares consolidate all Original Medicare benefits, consisting of Parts A, B and usually, D. In other words, they cover whatever an Original Medicare plan does but might feature geographical or network restrictions.This is best for those who travel frequently or want access to a wide variety of providers. Nevertheless, Initial Medicare comes with a coinsurance of 20%, which can result in high out-of-pocket expenses if your authorized Medicare amount is considerable. On the other hand, Medicare Advantage strategies have out-of-pocket limitations that can ensure you spend only a particular quantity before your coverage starts.

6 Easy Facts About Paul B Insurance Medicare Advantage Agent Shown

However, they are certainly not a good suitable for everybody. We are here to clarify why these relatively too-good-to-be-true plans have a less-than-stellar reputation. There are numerous reasons beneficiaries might feel Medicare Advantage plans are bad. Some insurance policy holders can offer a list of downsides, while others might be satisfied with their Medicare Benefit protection.

Considering that not all doctors accept Medicare Advantage prepares, it can be challenging to discover the right medical professional who takes your plan, leading to a hold-up in care. The biggest mistaken belief about Medicare Advantage plans is that they are totally free.

The Ultimate Guide To Paul B Insurance Best Medicare Agent Near Me

There is no such thing as a complimentary Medicare strategy. The main reason why Medicare Benefit carriers can offer low to zero-dollar regular monthly premium strategies is that Medicare pays the private business supplying the plans to take on your health danger. Not all Medicare Benefit strategies have a low premium expense.

Medicare Advantage plans frequently use additional advantages that you will not discover on a Medicare Supplement strategy. These extra advantages can trigger issues when paying for the services.

What Does Paul B Insurance Medicare Supplement Agent Mean?

The value of a Medicare Advantage plan depends on your area, health care needs, budget plan, and choices. So, for some, a Medicare Benefit strategy may be a good financial investment. If you do sporadically participate in doctors' appointments and are in fantastic health, you could end up getting more out of the plan than you put in.

The Ultimate Guide To Paul B Insurance Medicare Advantage Plans

This is your only opportunity to enroll in a Medigap strategy without addressing health questions. If you miss this one-time opportunity to register, you will have to respond to health concerns must you want to register in a Medicare Supplement plan in the future. This indicates the provider could reject your application due to pre-existing conditions.

See This Report about Paul B Insurance Medicare Agent Near Me

Are Medicare Advantage plans excellent or bad? In a lot of cases, Medicare Benefit plans are not the best coverage option available. Ultimately, it is essential to know what to get out of these strategies relating to rate and protection and become educated on which options are cost effective to you and provide the coverage you require.

The providers submit their bid based on costs per enrollee for medical services Original Medicare covers (Paul B Insurance Best Medicare Agent near me). basics Suppose the quote is greater than the benchmark quantity. In that case, the enrollee will pay the difference in the type of monthly premiums, which is why some Advantage plans have a zero-dollar premium and others have a month-to-month premium.

Facts About Paul B Insurance Medicare Agent Near Me Revealed

What is Medicare Benefit? What are the benefits and constraints of Medicare Benefit plans? Exist any defenses if I register in a strategy and do not like it? Are any Medicare Managed Care Plans readily available where I live? Medicare Advantage expands healthcare choices for Medicare beneficiaries. These choices were created with the Well balanced Budget Plan Act of 1997 to minimize the development in Medicare costs, make the Medicare trust fund last longer, and provide recipients more options.

How Paul B Insurance Medicare Advantage Plans can Save You Time, Stress, and Money.

It is very important to bear in mind that each of these alternatives will have advantages and limitations, and no alternative will be ideal for everyone. Not all options will be available in read this article all areas. Please Keep in mind: If you do not actively select and register click for source in a brand-new plan, you will remain in Original Medicare or the original Medicare handled care plan you currently have.

You need to not alter to a new program till you have actually carefully evaluated it and figured out how you would gain from it. Original Medicare will constantly be offered - Paul B Insurance Medicare Supplement Agent. If you desire to continue getting your benefits in this manner, then you do not have to do anything. This is a managed care strategy with a network of service providers who contract with an insurer.